London Heathrow Slot Allocation

Allocated landing slots may have a commercial value and can be traded between airlines. Continental Airlines paid US$ 209 million for four pairs of landing slots from GB Airways at London Heathrow Airport, $52.3m each. This Policy Brief reflects upon the discussions on Airport Slots Allocation Regime in Europe at the 11th Florence Air Forum On the dedicated webpage, the agenda of the event that took place in Budapest on 6th September 2019. All the speaker presentations are made available. Download full pdf – European Transport Regulation Observer – Policy Brief 2019/117 Read.

A landing slot, takeoff slot, or airport slot is a permission granted by the owner of an airport designated as Level 3 (Coordinated Airport), which allows the grantee to schedule a landing or departure at that airport during a specific time period.[1] Slots may be administered by the operator of the airport or by a government aviation regulator such as the U.S. Federal Aviation Administration.[2]

Landing slots are allocated in accordance with guidelines set down by the International Air Transport Association (IATA) Worldwide Airport Slots Group. All airports worldwide are categorized as either Level 1 (Non-Coordinated Airport), Level 2 (Schedules Facilitated Airport), or Level 3 (Coordinated Airport). At Level 2 airports, the principles governing slot allocation are less stringent; airlines periodically submit proposed schedules to the administrating authority, rather than historic performance. Participation is not mandatory, but reduces congestion and non-participants are penalized if the airport must later be designated level 3.[2]

- Changes to the current approach to airport slot allocation. This is particularly relevant in the context of the Aviation Strategy Green Paper and the debate about the allocation of future new capacity at Heathrow. Overall, we consider that there are strong arguments for moving to a market-based approach to slot allocation.

- Heathrow slot allocations based on alliance and core partnerships: Star Alliance remains unchanged whilst the inclusion of Aer Lingus and Virgin Atlantic give oneworld and SkyTeam a boost. There is lots of other interesting information in the Airport Coordination report. For example, on page 4 you can see who gained slots for Summer 2020.

As of summer 2017, a total of 123 airports in the world are Level 2 airports, and 177 are Level 3 airports.[3]

Allocated landing slots may have a commercial value and can be traded between airlines. Continental Airlines paid US$209 million for four pairs of landing slots from GB Airways at London Heathrow Airport, $52.3m each.[4] The highest price paid for a pair of take-off and landing slots at Heathrow Airport was $75m, paid by Oman Air to Air France–KLM for a prized early morning arrival, reported in February 2016. A year before, American Airlines paid $60m to Scandinavian Airlines.[5]

| Year | Buyer | Seller | daily slot pairs | transaction (£M) | slot value (£M) |

|---|---|---|---|---|---|

| 1998 | BA | Air UK | 4 | 15.6 | 3.9 |

| 2002 | BA | BA Connect | 5 | 13 | 2.6 |

| 2002 | BA | SN Brussels | 7 | 27.5 | 3.9 |

| 2003 | BA | SWISS | 8 | 22.5 | 2.8 |

| 2003 | BA | United | 2 | 12 | 6 |

| 2004 | Virgin | Flybe | 4 | 20 | 5 |

| 2004 | Qantas | Flybe | 2 | 20 | 10 |

| 2006 | BA | BWIA | 1 | 5 | 5 |

| 2007 | BA | Malev | 2 | 7 | 3.5 |

| 2007 | BA | BA | 7.3 | 30 | 4.1 |

| 2007 | Virgin | Air Jamaica | 1 | 5.1 | 5.1 |

| 2007 | BMI | 77.7 | 770 | 9.9 | |

| 2007 | unknown | Alitalia | 3 | 67 | 22.3 |

| 2008 | Continental | GB Airways/Alitalia/Air France | 4 | 104.5 | 26.1 |

| 2013 | Delta | unknown | 2 | 30.8 | 15.4 |

| 2013 | Etihad | Jet | 3 | 46.2 | 15.4 |

As supply is limited, slot trading became the main solution to enter Heathrow and transfers grew from 42 in 2000 to 526 in 2012 and over 10 years the average priced slot was equivalent to £4 per passenger.[7]

If an airline does not use an allocation of slots (typically 80% usage over six months), it can lose the rights. Airlines may operate ghost or empty flights to preserve slot allocations.[8] To avoid pollution and financial losses caused by an excessive number of empty flights, these rules have occasionally been waived during periods of temporary but widespread travel disruption, including after the September 11, 2001 attacks, and during the SARS epidemic, the Great Recession, and the COVID-19 pandemic.[9]

Level 3 coordinated airports[3][edit]

Australia[edit]

Austria[edit]

- Innsbruck Airport (winter season only)

Belgium[edit]

Brazil[edit]

Cambodia[edit]

Canada[edit]

Cape Verde[edit]

Colombia[edit]

Cuba[edit]

China[edit]

Czech Republic[edit]

Denmark[edit]

Finland[edit]

France[edit]

Germany[edit]

Ghana[edit]

- Kotoka International Airport - Accra

Greece[edit]

- Chania Airport (summer season only)

- Chios Airport (summer season only)

- Corfu Airport (summer season only)

- Heraklion Airport (summer season only)

- Kalamata Airport (summer season only)

- Karpathos Island National Airport (summer season only)

- Kavala Airport (summer season only)

- Kephalonia International Airport (summer season only)

- Kithira Airport (summer season only)

- Kos Airport (summer season only)

- Mykonos Airport (summer season only)

- Mytilene Airport (summer season only)

- Patras Airport (summer season only)

- Preveza Airport (summer season only)

- Rhodes Airport (summer season only)

- Samos Airport (summer season only)

- Sitia Public Airport (summer season only)

- Skiathos Airport (summer season only)

- Thira Airport (summer season only)

- Volos Airport (summer season only)

- Zakynthos International Airport (summer season only)

Greenland[edit]

Hong Kong[edit]

Iceland[edit]

India[edit]

- Chhatrapati Shivaji International Airport - Mumbai

- Indira Gandhi International Airport - Delhi

- Chennai International Airport - Chennai

- Rajiv Gandhi International Airport - Hyderabad

- Kempegowda International Airport - Bangalore

Indonesia[edit]

- Ngurah Rai International Airport - Denpasar

- Soekarno-Hatta International Airport - Jakarta

Ireland[edit]

Israel[edit]

Italy[edit]

- Lampedusa Airport (summer season only)

- Linate Airport - Milan

- Malpensa Airport - Milan

- Orio al Serio Airport - Milan

- Olbia Costa Smeralda Airport (summer season only)

- Pantelleria Airport (summer season only)

- Ciampino Airport - Rome

- Fiumicino Airport - Rome

Japan[edit]

Malaysia[edit]

Mauritius[edit]

- Sir Seewoosagur Ramgoolam International Airport - Mauritius

Mexico[edit]

Morocco[edit]

Netherlands[edit]

New Zealand[edit]

Norway[edit]

Pakistan[edit]

Philippines[edit]

Poland[edit]

Portugal[edit]

- Faro Airport (summer season only)

Russia[edit]

- Sheremetyevo Airport - Moscow

- Vnukovo International Airport - Moscow

Saudi Arabia[edit]

Singapore[edit]

South Africa[edit]

- King Shaka International Airport - Durban

- OR Tambo International Airport - Johannesburg

South Korea[edit]

Spain[edit]

- Ibiza Airport (summer season only)

- Menorca Airport (summer season only)

Sri Lanka[edit]

Sweden[edit]

Switzerland[edit]

Taiwan[edit]

Thailand[edit]

- Suvarnabhumi Airport - Bangkok

- Don Mueang International Airport - Bangkok

Tunisia[edit]

Turkey[edit]

- Antalya Airport - Antalya (summer season only)

Ukraine[edit]

- Boryspil International Airport - Kiev

United Arab Emirates[edit]

United Kingdom[edit]

United States[edit]

- John F. Kennedy International Airport - New York City

- LaGuardia Airport (not on IATA list, but slot controlled)[10]

- Ronald Reagan Washington National Airport - Washington, D.C. (not on IATA list, but slot controlled)[10]

Vietnam[edit]

- Noi Bai International Airport - Hanoi

- Tan Son Nhat International Airport - Ho Chi Minh City

References[edit]

- ^'Worldwide Slot Guidelines, 9th Edition English Version'(PDF). IATA. 1 January 2019. p. 14.

- ^ abSlot Administration - U.S. Level 2 Airports

- ^ ab'List of all Level 2 and Level 3 airports'. iata.org. 29 May 2018.

- ^'Continental pays Heathrow record'. Financial Times. March 3, 2008.

- ^'Oman breaks Heathrow record with deal for slots'. The Sunday Times. 14 February 2016.

- ^'Heathrow Airport's slot machine: hitting the jackpot again?'. CAPA centre for aviation. 8 May 2013.

- ^'Heathrow Airport: An introduction to Secondary Slot Trading'(PDF). Airport Coordination Limited. 30 September 2012. Archived from the original(PDF) on 4 March 2016.

- ^Green anger at 'ghost flights'

- ^Paul Sillers (12 March 2020). 'Ghost flights: Why our skies are full of empty planes'.

- ^ ab'Airport Reservation Office'. Federal Aviation Administration (FAA).

London Heathrow is by far the UK’s busiest airport. It handles nearly twice as many passengers and aircraft movements as second-placed Gatwick. In fact, it has consistently been ranked as the busiest airport in the whole of Europe by passenger traffic.

However, to facilitate such figures, the airport operates at full capacity. This makes preferable slots at the airport difficult to obtain. But which airlines have been the winners and losers from the latest round of slot allocations?

Stay informed: Sign up for our daily aviation news digest.

Congestion in the capital

London Heathrow Slot Allocation Calculator

An airfield has existed on the site of Heathrow since 1929. However, it did not become a commercial airport until after the Second World War, in 1946. Despite this slow start, it has since become a major hub of international air travel. Over the course of its history, Heathrow has been home to such iconic aircraft as British Airways’ supersonic ‘Concorde‘ airliners.

According to the Civil Aviation Authority, 2019 saw the airport handle almost 81 million passengers (1% annual increase) over nearly 480,000 aircraft movements. However, these record figures have led to the airport becoming increasingly congested. This has prompted the airport to propose a significant expansion, including a new, third runway. However, this has been met with strong opposition by both environmental groups and the local community.

Interestingly, the ongoing coronavirus pandemic has caused a rethink regarding the necessity of the proposed expansion. Indeed, earlier in the year, Heathrow operated using just one of its two existing runways. Nonetheless, the slot allocation process for the summer 2021 schedule has proved fiercely competitive. Indeed, the aforementioned capacity issues have prevented some airlines from obtaining their desired slots. But who exactly has been the most successful?

Slot allocations – the winners

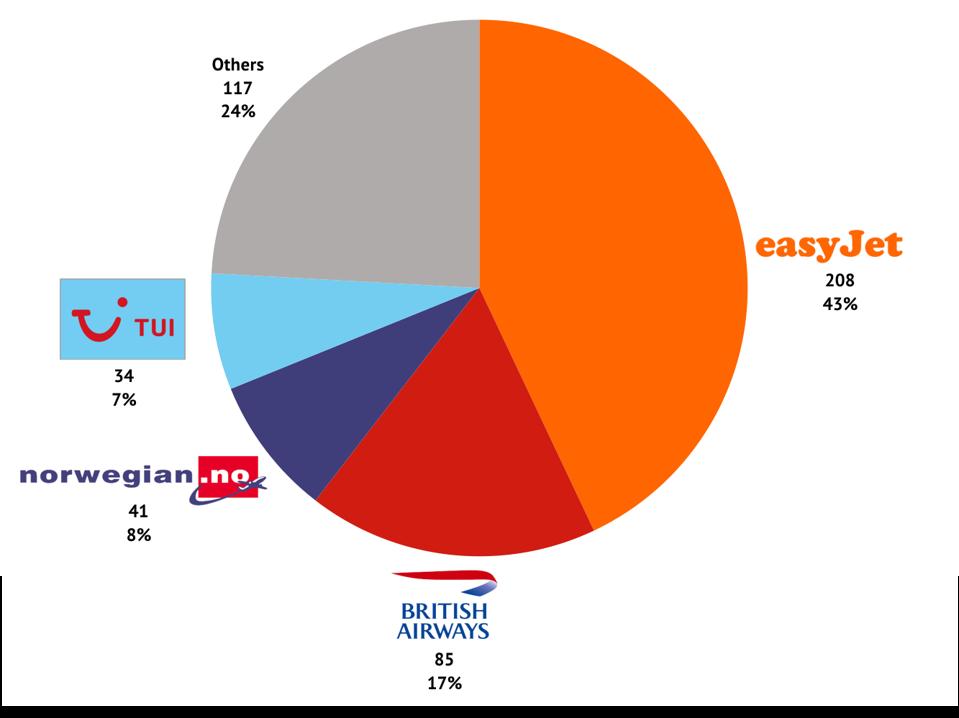

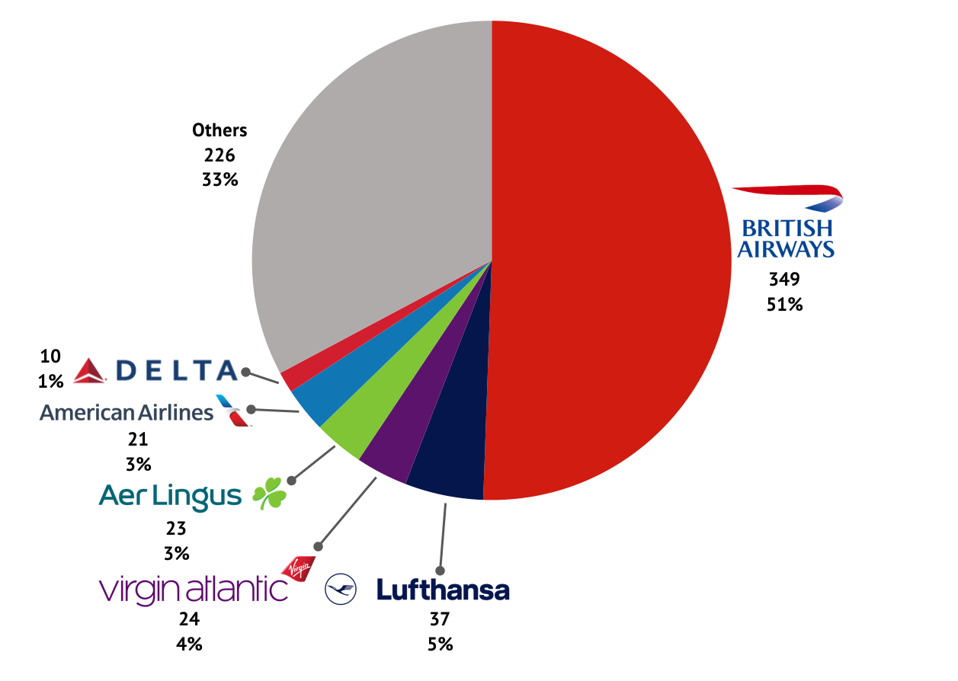

London Heathrow Slot Allocation Chart

Airport Coordination Limited (ACL) recently published its data concerning slot allocations at Heathrow for summer 2021. In total, 299,642 slots have been allocated across the next financial year (April 2021-April 2022). This represents a 1% increase over the previous year (298,483), and 87.5% of the total requested slots for this period (342,558).

Several airlines have been very successful in obtaining their desired slots for this period. Some have even had 100% of their requests met. These were generally smaller airlines. Such carriers could be given more flexibility due to having applied for fewer slots. They included the likes of Air Mauritius (186 slots) and Shenzen Airlines (310 slots).

However, compromises had to be made to facilitate this allocation. One sixth of Air Mauritius’ slots are 15-25 minutes outside the requested times, and a further 1/6 are more than two hours off. Ten percent of Shenzhen Airlines slots are also over two hours outside the requested times. On the other hand, larger carriers such as American Airlines (9,548 slots) and Lufthansa (15,368 slots) were able to get all their slots at the requested times. Perhaps this shows the influence of flag carrier airlines on the slot allocation process.

London Heathrow Slot Allocation Chart

The losers

However, the allocation rate of 87.5% does mean that some 42,916 requests had to be turned down. As such, several airlines did not obtain any of their requested slots. These included regional carriers such as Eastern Airways (2,108 requests) and Loganair (4,278 requests). However, the airport’s long-haul slots were also subject to significant levels of refusal.

A lot has been made of JetBlue’s proposed launch of flights from New York and Boston to London. However, while Heathrow was the airline’s desired airport, it could not obtain any slots (1,302 requests) there for the coming summer. Instead, its new transatlantic flights will serve Gatwick and Stansted. Other long-haul carriers with a 0% success rate included China Airlines (310 requests) and Canadian hybrid carrier WestJet (1,680 requests).

At first, LOT Polish Airlines appears to have lost out, having only obtained 50% of its requested slots (1,300/2,602) for the next financial year. However, 1,300 represents the same amount of slots that it had last year. As such, it could be the case that airlines apply for more than they need as a contingency measure.

A curious example to end on is Uzbekistan Airways. This carrier obtained all of the 124 slots that it requested for the coming financial year. However, all 124 of these were more than two hours outside the carrier’s requested times! Overall, it seems that, in the slot allocation business, one certainly has to be willing to compromise.