Casino Money Laundering Stages

A few days ago, seven suspects faced charges with an attempted money laundering of more than $350,000 in the Harrah’s Cherokee Hotel and Casino in North Carolina. A total of $2.1 million was also seized by federal officials.

As revealed in a federal indictment that has been recently released, two of the individuals – Jeremy Brandon Latourneau and Derick Keane (both 43 years old), along with a third person, Roosevelt Hunt, went to the Cherokee gambling establishment in 2019. While being there they bought casino chips worth $200,000. Federal prosecutors revealed that the three of them gambled for less than two hours and eventually left the casino with $198,75 in cash.

Several days later, Latourneau and Keane went back to the casino venue, with each of them trying to cash a $50,000 check. The attempt, however, was considered suspicious by the casino staff, who refused to cash the checks, provided the earlier activity of the two men. At a later stage, federal officials found out that over $359,000 linked to the money laundering lot was dishonestly acquired via a federal Paycheck Protection Program loan. The latter was earmarked for coronavirus relief.

About $2.1 Million Was Associated with the Money Laundering Plot

- Anti-Money Laundering Policy. As soon as the Player opens an account with Big 5 Casino, the Player is agreeing to abide by all the rules and regulations relating to anti-money laundering that are in place. In short, the Player binds himself not to use funds that are, in any way whatsoever, the proceeds of crime.

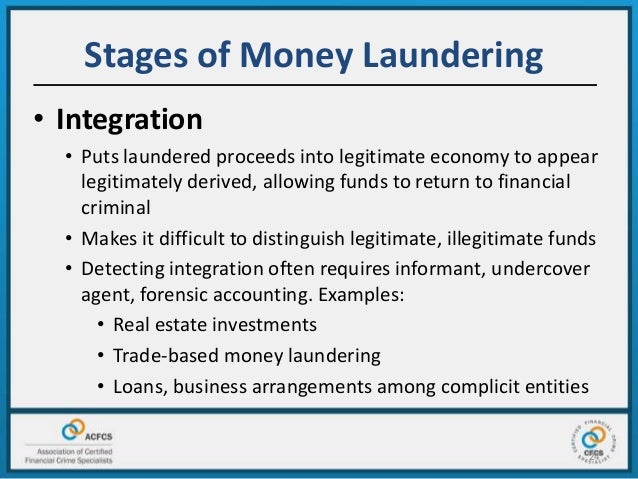

- The final stage of the money laundering process is termed the integration stage. It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources.

- There are three stages involved in money laundering; placement, layering and integration.

There are 3 stages of money laundering. In the first stage, money enters the banking system. This stage is termed as placement. Second phase involves mixing the funds. You go into Macau with a suitcase full of money, buy a ton of casino chips, and then you wander around. You then cash in the chips and claim that you just got really, really lucky at bacarrat.

The 41-year-old Christopher J. Agard, who is one of the seven suspects, allegedly used his business, Wild Stylz Entertainment, to launder money. Back in May 2020, he asked the Government for a PPP loan amounting to over $395,000. The authorities later approved the application, which turned out t be made by using fraudulent documents.

Based on evidence that the investigators collected so far, the plot led to the laundering of more than $750,000, which was fraudulently obtained. The rest of the $2.1 million, which federal investigators seized, was indirectly related to the plot.

Last week, every one of the seven suspects faced charges with conspiracy to commit money laundering. They were also charged with conspiracy to commit wire fraud. One more suspect, on the other hand, made a plea agreement and confessed to drug conspiracy and money laundering charges.

As revealed by federal officials, the case started with an investigation of illegal drug dealing and dates to 2017. As claimed by prosecutors, some traffickers of methamphetamine and heroine were involved. The federal program that investigates considerable drug violations and some money-laundering crimes related to them, the US Organized Crime Drug Enforcement Task Force, was also involved in the inquiry. The OCDETF’s probe ended up with the arrest of eight other suspects on federal drug trafficking charges and charges related to fraud.

As further found by federal agents, an associated money laundering scheme and wire fraud were taking place. The investigation led to the latest charges, with federal officials making a promise to investigate any crimes that may have been related to misuse of coronavirus relief money.

Methods and Stages of Money Laundering

There are three stages involved in money laundering; placement, layering and integration.

Trump Casino Money Laundering Charges

Placement –This is the movement of cash from its source. On occasion the source can be easily disguised or misrepresented. This is followed by placing it into circulation through financial institutions, casinos, shops, bureau de change and other businesses, both local and abroad. The process of placement can be carried out through many processes including:

Money Laundering Stages Diagram

- Currency Smuggling – This is the physical illegal movement of currency and monetary instruments out of a country. The various methods of transport do not leave a discernible audit trail FATF 1996-1997 Report on Money Laundering Typologies.

- Bank Complicity – This is when a financial institution, such as banks, is owned or controlled by unscrupulous individuals suspected of conniving with drug dealers and other organised crime groups. This makes the process easy for launderers. The complete liberalisation of the financial sector without adequate checks also provides leeway for laundering.

- Currency Exchanges – In a number of transitional economies the liberalisation of foreign exchange markets provides room for currency movements and as such laundering schemes can benefit from such policies.

- Securities Brokers – Brokers can facilitate the process of money laundering through structuring large deposits of cash in a way that disguises the original source of the funds.

- Blending of Funds – The best place to hide cash is with a lot of other cash. Therefore, financial institutions may be vehicles for laundering. The alternative is to use the money from illicit activities to set up front companies. This enables the funds from illicit activities to be obscured in legal transactions.

- Asset Purchase – The purchase of assets with cash is a classic money laundering method. The major purpose is to change the form of the proceeds from conspicuous bulk cash to some equally valuable but less conspicuous form.

Layering – The purpose of this stage is to make it more difficult to detect and uncover a laundering activity. It is meant to make the trailing of illegal proceeds difficult for the law enforcement agencies. The known methods are:

- Cash converted into Monetary Instruments – Once the placement is successful within the financial system by way of a bank or financial institution, the proceeds can then be converted into monetary instruments. This involves the use of banker’s drafts and money orders.

- Material assets bought with cash then sold – Assets that are bought through illicit funds can be resold locally or abroad and in such a case the assets become more difficult to trace and thus seize.

Levels Of Money Laundering

Integration – This is the movement of previously laundered money into the economy mainly through the banking system and thus such monies appear to be normal business earnings. This is dissimilar to layering, for in the integration process detection and identification of laundered funds is provided through informants. The known methods used are:

- Property Dealing – The sale of property to integrate laundered money back into the economy is a common practice amongst criminals. For instance, many criminal groups use shell companies to buy property; hence proceeds from the sale would be considered legitimate.

- Front Companies and False Loans – Front companies that are incorporated in countries with corporate secrecy laws, in which criminals lend themselves their own laundered proceeds in an apparently legitimate transaction.

- Foreign Bank Complicity – Money laundering using known foreign banks represents a higher order of sophistication and presents a very difficult target for law enforcement. The willing assistance of the foreign banks is frequently protected against law enforcement scrutiny. This is not only through criminals, but also by banking laws and regulations of other sovereign countries.

- False Import/Export Invoices – The use of false invoices by import/export companies has proven to be a very effective way of integrating illicit proceeds back into the economy. This involves the overvaluation of entry documents to justify the funds later deposited in domestic banks and/or the value of funds received from exports.